The Pitfalls of Relying on Public Policy to Drive Financial Inclusion

Government efforts to enhance financial inclusion often face political and industry resistance, as seen with the recent SBA direct lending proposal. In our latest blog, we explore global examples of state intervention, historical constraints, and how innovation can fill the gaps left by public policy. Discover why relying solely on government may not be enough and how tech can drive sustainable financial inclusion.

Soham Sen

12 June 2024

•

10 min read

Is It Worth It?

Growing up in Northern Michigan taught me perseverance, a lesson businesses need in decision-making. For banks, profitability is the main barrier to financial inclusion. Addressing small business needs is often unprofitable compared to larger loans. This blog explores why banks prioritize larger loans and discusses ways to overcome these barriers, emphasizing the importance of financial inclusion for society.

If Financial Inclusion is such a big deal, why are so many left out?

If financial inclusion is such a big deal, why are so many on the outside looking in? In this post, I explore six key barriers that keep people out of the formal financial system or lead them to drop out: financial literacy, dwindling bank branches alongside a digital divide, language access, documentation requirements, a trust deficit, and fees. (I think there is actually a seventh, but I'll cover that in the next post!)

The Promise of Financial Inclusion

Financial inclusion gets to the heart of our mission here at Vaya. It’s one of the core concepts that I use to describe our work. But sometimes I get the feeling that I should be more clear about what I’m talking about. In this post then, I’ll try to clarify what I mean when I say financial inclusion and why this matters to all of us.

Soham Sen

03 October 2023

•

4 min read

How we set up runtime type checking for our TypeScript application

TypeScript is one of the most favourite language for Devs. As everything that is good, it too have some flaws. We take runtime type-checking for today and see how we at Vaya found a solution to get better at it.

Hemachandran G

15 March 2023

•

4 min read

How We Think About Small Businesses at Vaya

We started to build Vaya inspired by the people who own and operate small businesses (SBs) as I wrote about in

my last post. But inspiration is rarely enough to build a company around. We needed to think hard about what we could actually do. We also needed to better understand what SBs are like as a group and what challenges they face.

Soham Sen

02 March 2023

•

5 min read

Why we at Vaya care about Small Businesses

Why small businesses? The question inevitably comes with a quizzical expression probing whether there is some web3 or blockchain angle in there somewhere. After two years of building Vaya and explaining what we do at interviews, investor meetings, family dinners and the occasional cocktail party, I can now see that look coming: why focus on small businesses of all things?

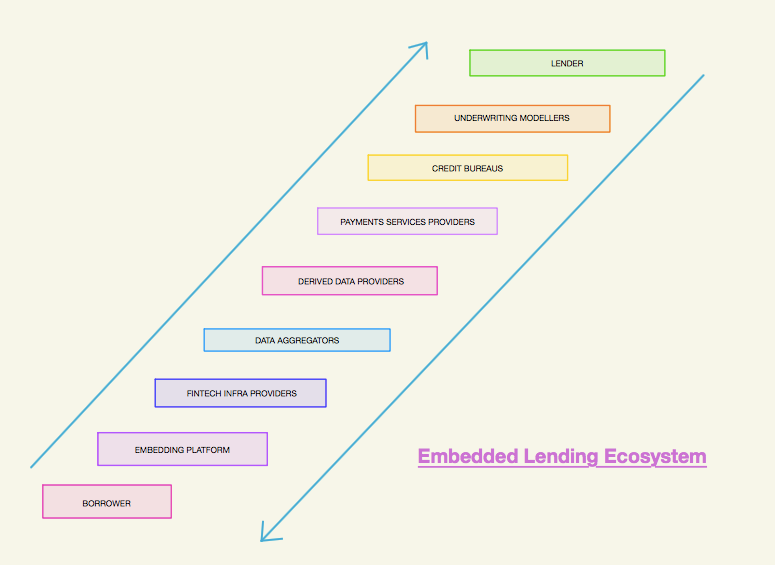

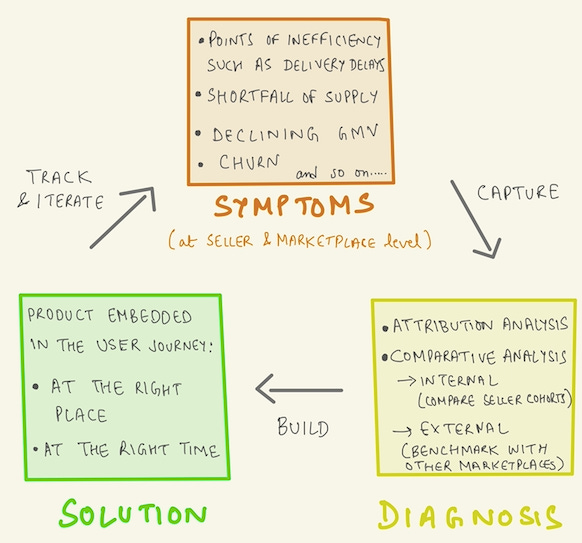

The Embedded Lending Value Chain

Credit is a complex transaction. Just dig a layer underneath it and you witness the interweaving of many different entities that make a single transaction happen.In the previous post, we built the business case for a platform to embed credit. They facilitate the ‘pull point’ that initiates an instance of a borrower applying for credit.

The Embedding Business Case - Platform Edition

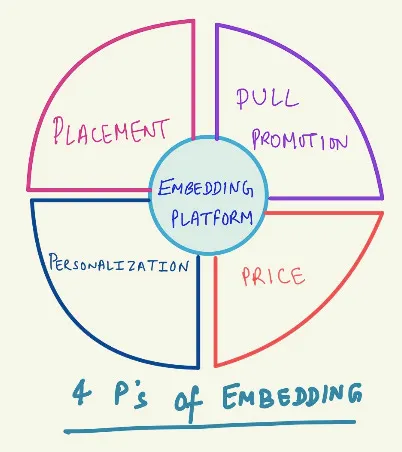

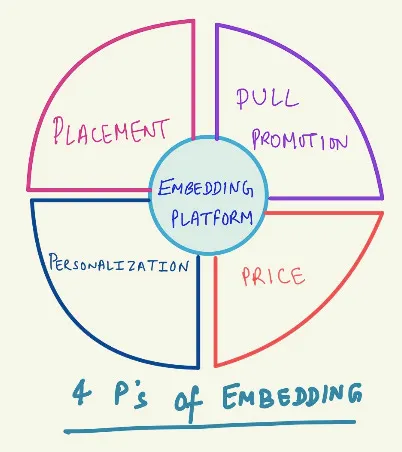

In the previous posts, we covered the

‘4Ps framework of Embedding’ and how the businesses considering ‘embedding’ can think about

‘Product Market Fit in Embedded Finance’.

Ankit

26 March 2021

•

3 min read

Emb.F[x] and what's coming next

Software ate the world. It permeates every walk of our life today. It is truly intertwined with everything we do and surfaces wherever we go. We must ask ourselves; has it grown to support us and improve quality of life as expected in every sense or has it grown unencumbered like a wild weed in some ways and is in need of pruning?

Ankit

10 March 2021

•

6 min read